Sunday, March 1, 2020

One of the big solutions to climate change and global warming...

Fare-free public transportation... bus and rail: city, state and nationally.

Wages and Poverty

A wage study from the Social Security Administration no one wants to talk about... people work so they aren't poor... yet, here are the facts that working often makes people poor:

https://www.ssa.gov/cgi-bin/netcomp.cgi?year=2014&fbclid=IwAR3sfvx3eYzOb1LvZyKtOw0lio6hDBuxL9NDyD-N1ka1ECdW_8NVyeusvtU

This study below is from 2014...

Now check out the latest study from 2018:

https://www.ssa.gov/cgi-bin/netcomp.cgi?year=2020

Facts do matter:

Note: None of these studies take into consideration wages versus the actual "cost-of-living." When the real "cost-of-living" factors are figured in, the working class as a whole, which produces all wealth, is more impoverished now than in 2014.

Question:

What kind of society allows those who produce all the wealth, the working class, to live in worsening social and economic conditions after creating so much wealth?

Question:

Should we be discussing wealth and poverty and wage labor and capitalist exploitation?

Question:

How do we correct this?

https://www.ssa.gov/cgi-bin/netcomp.cgi?year=2014&fbclid=IwAR3sfvx3eYzOb1LvZyKtOw0lio6hDBuxL9NDyD-N1ka1ECdW_8NVyeusvtU

This study below is from 2014...

Now check out the latest study from 2018:

https://www.ssa.gov/cgi-bin/netcomp.cgi?year=2020

Facts do matter:

Note: None of these studies take into consideration wages versus the actual "cost-of-living." When the real "cost-of-living" factors are figured in, the working class as a whole, which produces all wealth, is more impoverished now than in 2014.

Question:

What kind of society allows those who produce all the wealth, the working class, to live in worsening social and economic conditions after creating so much wealth?

Question:

Should we be discussing wealth and poverty and wage labor and capitalist exploitation?

Question:

How do we correct this?

| Social Security Online | Automatic Increases |

| Office of the Chief Actuary |

Wage Statistics for 2014 |

Automatic increases Development of the AWI |

The national average wage index (AWI) is based on

compensation (wages, tips, and the like) subject to Federal income taxes, as reported

by employers on Forms W-2. Beginning with the AWI for 1991, compensation includes

contributions to deferred compensation plans, but excludes certain distributions from

plans where the distributions are included in the reported compensation subject to

income taxes. We call the result of including contributions, and excluding certain

distributions, net compensation. The table below summarizes the components of

net compensation for 2014.

|

| Wage earners | Net compensation | ||||

|---|---|---|---|---|---|

| Net compensation interval | Number | Cumulative number |

Percent of total |

Aggregate amount | Average amount |

| $0.01 — 4,999.99 | 22,574,440 | 22,574,440 | 14.27075 | $46,647,919,125.68 | $2,066.40 |

| 5,000.00 — 9,999.99 | 13,848,841 | 36,423,281 | 23.02549 | 102,586,913,092.61 | 7,407.62 |

| 10,000.00 — 14,999.99 | 12,329,270 | 48,752,551 | 30.81961 | 153,566,802,438.45 | 12,455.47 |

| 15,000.00 — 19,999.99 | 11,505,776 | 60,258,327 | 38.09315 | 200,878,198,035.07 | 17,458.90 |

| 20,000.00 — 24,999.99 | 10,918,555 | 71,176,882 | 44.99547 | 245,317,570,246.88 | 22,467.95 |

| 25,000.00 — 29,999.99 | 10,192,863 | 81,369,745 | 51.43903 | 279,865,461,187.05 | 27,457.00 |

| 30,000.00 — 34,999.99 | 9,487,840 | 90,857,585 | 57.43690 | 307,828,947,411.16 | 32,444.58 |

| 35,000.00 — 39,999.99 | 8,578,215 | 99,435,800 | 62.85974 | 321,200,755,103.44 | 37,443.78 |

| 40,000.00 — 44,999.99 | 7,553,972 | 106,989,772 | 67.63509 | 320,563,569,965.15 | 42,436.43 |

| 45,000.00 — 49,999.99 | 6,542,882 | 113,532,654 | 71.77126 | 310,391,706,424.23 | 47,439.60 |

| 50,000.00 — 54,999.99 | 5,723,269 | 119,255,923 | 75.38931 | 300,016,377,448.51 | 52,420.46 |

| 55,000.00 — 59,999.99 | 4,846,517 | 124,102,440 | 78.45310 | 278,354,367,841.41 | 57,433.90 |

| 60,000.00 — 64,999.99 | 4,201,232 | 128,303,672 | 81.10897 | 262,203,932,128.68 | 62,411.20 |

| 65,000.00 — 69,999.99 | 3,573,471 | 131,877,143 | 83.36799 | 240,948,179,180.40 | 67,426.93 |

| 70,000.00 — 74,999.99 | 3,094,739 | 134,971,882 | 85.32437 | 224,145,278,103.36 | 72,427.85 |

| 75,000.00 — 79,999.99 | 2,684,481 | 137,656,363 | 87.02140 | 207,853,372,824.62 | 77,427.77 |

| 80,000.00 — 84,999.99 | 2,297,338 | 139,953,701 | 88.47370 | 189,370,862,869.17 | 82,430.56 |

| 85,000.00 — 89,999.99 | 1,975,400 | 141,929,101 | 89.72248 | 172,719,042,418.70 | 87,434.97 |

| 90,000.00 — 94,999.99 | 1,714,370 | 143,643,471 | 90.80624 | 158,442,931,588.44 | 92,420.50 |

| 95,000.00 — 99,999.99 | 1,486,636 | 145,130,107 | 91.74604 | 144,858,203,365.61 | 97,440.26 |

| 100,000.00 — 104,999.99 | 1,309,068 | 146,439,175 | 92.57358 | 134,083,282,259.67 | 102,426.52 |

| 105,000.00 — 109,999.99 | 1,117,128 | 147,556,303 | 93.27979 | 120,020,513,136.11 | 107,436.67 |

| 110,000.00 — 114,999.99 | 977,055 | 148,533,358 | 93.89745 | 109,855,105,705.14 | 112,434.93 |

| 115,000.00 — 119,999.99 | 865,889 | 149,399,247 | 94.44483 | 101,693,061,676.62 | 117,443.53 |

| 120,000.00 — 124,999.99 | 773,339 | 150,172,586 | 94.93371 | 94,660,281,091.31 | 122,404.64 |

| 125,000.00 — 129,999.99 | 673,971 | 150,846,557 | 95.35977 | 85,886,152,964.93 | 127,433.01 |

| 130,000.00 — 134,999.99 | 595,827 | 151,442,384 | 95.73643 | 78,899,843,713.01 | 132,420.73 |

| 135,000.00 — 139,999.99 | 527,341 | 151,969,725 | 96.06980 | 72,476,546,845.30 | 137,437.72 |

| 140,000.00 — 144,999.99 | 466,992 | 152,436,717 | 96.36501 | 66,519,743,635.12 | 142,443.00 |

| 145,000.00 — 149,999.99 | 419,003 | 152,855,720 | 96.62989 | 61,787,674,520.19 | 147,463.56 |

| 150,000.00 — 154,999.99 | 384,581 | 153,240,301 | 96.87301 | 58,607,775,121.57 | 152,393.84 |

| 155,000.00 — 159,999.99 | 335,391 | 153,575,692 | 97.08503 | 52,801,735,517.69 | 157,433.37 |

| 160,000.00 — 164,999.99 | 296,048 | 153,871,740 | 97.27218 | 48,087,213,596.86 | 162,430.46 |

| 165,000.00 — 169,999.99 | 265,309 | 154,137,049 | 97.43990 | 44,426,198,104.69 | 167,450.78 |

| 170,000.00 — 174,999.99 | 239,515 | 154,376,564 | 97.59131 | 41,304,379,348.95 | 172,450.07 |

| 175,000.00 — 179,999.99 | 216,255 | 154,592,819 | 97.72802 | 38,370,042,895.27 | 177,429.62 |

| 180,000.00 — 184,999.99 | 200,592 | 154,793,411 | 97.85483 | 36,588,064,085.78 | 182,400.42 |

| 185,000.00 — 189,999.99 | 179,005 | 154,972,416 | 97.96799 | 33,554,727,208.93 | 187,451.34 |

| 190,000.00 — 194,999.99 | 165,277 | 155,137,693 | 98.07247 | 31,807,897,759.84 | 192,452.05 |

| 195,000.00 — 199,999.99 | 154,070 | 155,291,763 | 98.16987 | 30,425,466,536.83 | 197,478.20 |

| 200,000.00 — 249,999.99 | 1,039,897 | 156,331,660 | 98.82726 | 230,863,458,226.21 | 222,006.08 |

| 250,000.00 — 299,999.99 | 565,105 | 156,896,765 | 99.18450 | 153,945,762,663.99 | 272,419.75 |

| 300,000.00 — 349,999.99 | 333,584 | 157,230,349 | 99.39537 | 107,708,119,615.81 | 322,881.55 |

| 350,000.00 — 399,999.99 | 219,923 | 157,450,272 | 99.53440 | 82,117,070,706.61 | 373,390.10 |

| 400,000.00 — 449,999.99 | 151,162 | 157,601,434 | 99.62996 | 63,997,346,472.50 | 423,369.28 |

| 450,000.00 — 499,999.99 | 108,881 | 157,710,315 | 99.69879 | 51,583,042,398.64 | 473,756.14 |

| 500,000.00 — 999,999.99 | 345,935 | 158,056,250 | 99.91748 | 230,331,407,862.96 | 665,822.79 |

| 1,000,000.00 — 1,499,999.99 | 65,548 | 158,121,798 | 99.95892 | 78,672,933,288.58 | 1,200,233.92 |

| 1,500,000.00 — 1,999,999.99 | 24,140 | 158,145,938 | 99.97418 | 41,431,838,733.52 | 1,716,314.78 |

| 2,000,000.00 — 2,499,999.99 | 12,137 | 158,158,075 | 99.98185 | 26,997,226,154.27 | 2,224,373.91 |

| 2,500,000.00 — 2,999,999.99 | 6,871 | 158,164,946 | 99.98619 | 18,747,446,313.27 | 2,728,488.77 |

| 3,000,000.00 — 3,499,999.99 | 4,799 | 158,169,745 | 99.98923 | 15,507,304,422.66 | 3,231,361.62 |

| 3,500,000.00 — 3,999,999.99 | 3,258 | 158,173,003 | 99.99129 | 12,166,741,762.34 | 3,734,420.43 |

| 4,000,000.00 — 4,499,999.99 | 2,353 | 158,175,356 | 99.99277 | 9,970,953,222.98 | 4,237,549.18 |

| 4,500,000.00 — 4,999,999.99 | 1,822 | 158,177,178 | 99.99393 | 8,633,941,395.34 | 4,738,716.46 |

| 5,000,000.00 — 9,999,999.99 | 6,468 | 158,183,646 | 99.99802 | 43,887,775,808.42 | 6,785,370.41 |

| 10,000,000.00 — 19,999,999.99 | 2,230 | 158,185,876 | 99.99942 | 30,065,006,121.19 | 13,482,065.53 |

| 20,000,000.00 — 49,999,999.99 | 776 | 158,186,652 | 99.99992 | 22,450,911,983.01 | 28,931,587.61 |

| 50,000,000.00 and over | 134 | 158,186,786 | 100.00000 | 11,564,829,969.82 | 86,304,701.27 |

| Privacy Policy | Website Policies & Other Important Information | Site Map | |

Wage Statistics for 2018

Automatic increases Development of the AWI |

The national average wage index (AWI) is based on

compensation (wages, tips, and the like) subject to Federal income taxes, as reported

by employers on Forms W-2. Beginning with the AWI for 1991, compensation includes

contributions to deferred compensation plans, but excludes certain distributions from

plans where the distributions are included in the reported compensation subject to

income taxes. We call the result of including contributions, and excluding certain

distributions, net compensation. The table below summarizes the components of

net compensation for 2018.

|

| Wage earners | Net compensation | ||||

|---|---|---|---|---|---|

| Net compensation interval | Number | Cumulative number |

Percent of total |

Aggregate amount | Average amount |

| $0.01 — 4,999.99 | 20,912,646 | 20,912,646 | 12.47255 | $43,795,099,366.21 | $2,094.19 |

| 5,000.00 — 9,999.99 | 12,993,812 | 33,906,458 | 20.22222 | 96,170,371,134.60 | 7,401.24 |

| 10,000.00 — 14,999.99 | 11,550,542 | 45,457,000 | 27.11110 | 143,915,223,674.78 | 12,459.61 |

| 15,000.00 — 19,999.99 | 10,937,984 | 56,394,984 | 33.63465 | 191,083,130,375.42 | 17,469.68 |

| 20,000.00 — 24,999.99 | 10,930,426 | 67,325,410 | 40.15368 | 245,963,571,026.59 | 22,502.65 |

| 25,000.00 — 29,999.99 | 10,649,685 | 77,975,095 | 46.50528 | 292,595,699,011.64 | 27,474.59 |

| 30,000.00 — 34,999.99 | 10,157,201 | 88,132,296 | 52.56316 | 329,598,837,106.29 | 32,449.77 |

| 35,000.00 — 39,999.99 | 9,281,197 | 97,413,493 | 58.09858 | 347,575,046,812.88 | 37,449.38 |

| 40,000.00 — 44,999.99 | 8,242,459 | 105,655,952 | 63.01448 | 349,799,179,987.80 | 42,438.69 |

| 45,000.00 — 49,999.99 | 7,405,906 | 113,061,858 | 67.43145 | 351,372,718,041.82 | 47,444.93 |

| 50,000.00 — 54,999.99 | 6,542,812 | 119,604,670 | 71.33366 | 343,025,577,206.83 | 52,427.85 |

| 55,000.00 — 59,999.99 | 5,612,864 | 125,217,534 | 74.68124 | 322,379,314,296.40 | 57,435.80 |

| 60,000.00 — 64,999.99 | 4,920,595 | 130,138,129 | 77.61594 | 307,114,651,240.23 | 62,414.13 |

| 65,000.00 — 69,999.99 | 4,239,330 | 134,377,459 | 80.14433 | 285,846,106,689.33 | 67,427.19 |

| 70,000.00 — 74,999.99 | 3,682,829 | 138,060,288 | 82.34081 | 266,740,577,128.07 | 72,428.17 |

| 75,000.00 — 79,999.99 | 3,208,818 | 141,269,106 | 84.25459 | 248,463,045,944.21 | 77,431.33 |

| 80,000.00 — 84,999.99 | 2,780,381 | 144,049,487 | 85.91284 | 229,208,728,016.53 | 82,437.88 |

| 85,000.00 — 89,999.99 | 2,403,623 | 146,453,110 | 87.34639 | 210,164,860,939.67 | 87,436.70 |

| 90,000.00 — 94,999.99 | 2,117,062 | 148,570,172 | 88.60904 | 195,678,875,591.61 | 92,429.45 |

| 95,000.00 — 99,999.99 | 1,836,034 | 150,406,206 | 89.70407 | 178,907,004,914.35 | 97,442.10 |

| 100,000.00 — 104,999.99 | 1,625,690 | 152,031,896 | 90.67365 | 166,523,614,588.61 | 102,432.58 |

| 105,000.00 — 109,999.99 | 1,410,799 | 153,442,695 | 91.51507 | 151,582,528,351.71 | 107,444.45 |

| 110,000.00 — 114,999.99 | 1,251,905 | 154,694,600 | 92.26172 | 140,759,527,453.30 | 112,436.27 |

| 115,000.00 — 119,999.99 | 1,112,417 | 155,807,017 | 92.92518 | 130,658,936,970.24 | 117,455.00 |

| 120,000.00 — 124,999.99 | 1,008,410 | 156,815,427 | 93.52660 | 123,445,569,084.30 | 122,416.05 |

| 125,000.00 — 129,999.99 | 893,730 | 157,709,157 | 94.05964 | 113,899,350,244.55 | 127,442.68 |

| 130,000.00 — 134,999.99 | 795,949 | 158,505,106 | 94.53435 | 105,394,346,162.49 | 132,413.44 |

| 135,000.00 — 139,999.99 | 704,467 | 159,209,573 | 94.95450 | 96,825,136,762.18 | 137,444.53 |

| 140,000.00 — 144,999.99 | 632,559 | 159,842,132 | 95.33177 | 90,103,990,021.70 | 142,443.61 |

| 145,000.00 — 149,999.99 | 568,126 | 160,410,258 | 95.67060 | 83,773,312,894.63 | 147,455.52 |

| 150,000.00 — 154,999.99 | 514,078 | 160,924,336 | 95.97721 | 78,345,402,361.02 | 152,399.83 |

| 155,000.00 — 159,999.99 | 457,177 | 161,381,513 | 96.24987 | 71,980,277,465.39 | 157,445.10 |

| 160,000.00 — 164,999.99 | 413,863 | 161,795,376 | 96.49671 | 67,227,968,053.70 | 162,440.15 |

| 165,000.00 — 169,999.99 | 369,549 | 162,164,925 | 96.71711 | 61,877,593,240.22 | 167,440.84 |

| 170,000.00 — 174,999.99 | 327,834 | 162,492,759 | 96.91263 | 56,534,539,025.14 | 172,448.68 |

| 175,000.00 — 179,999.99 | 297,171 | 162,789,930 | 97.08987 | 52,729,141,686.28 | 177,437.04 |

| 180,000.00 — 184,999.99 | 275,711 | 163,065,641 | 97.25431 | 50,292,801,283.59 | 182,411.30 |

| 185,000.00 — 189,999.99 | 246,893 | 163,312,534 | 97.40156 | 46,281,835,141.84 | 187,457.06 |

| 190,000.00 — 194,999.99 | 227,017 | 163,539,551 | 97.53695 | 43,688,908,036.57 | 192,447.74 |

| 195,000.00 — 199,999.99 | 213,964 | 163,753,515 | 97.66456 | 42,253,967,707.90 | 197,481.67 |

| 200,000.00 — 249,999.99 | 1,422,744 | 165,176,259 | 98.51310 | 315,840,558,223.01 | 221,993.95 |

| 250,000.00 — 299,999.99 | 770,463 | 165,946,722 | 98.97262 | 210,183,088,243.46 | 272,801.01 |

| 300,000.00 — 349,999.99 | 465,576 | 166,412,298 | 99.25029 | 150,344,927,027.33 | 322,922.42 |

| 350,000.00 — 399,999.99 | 301,514 | 166,713,812 | 99.43012 | 112,548,961,845.06 | 373,279.39 |

| 400,000.00 — 449,999.99 | 207,014 | 166,920,826 | 99.55359 | 87,659,845,451.61 | 423,448.88 |

| 450,000.00 — 499,999.99 | 145,935 | 167,066,761 | 99.64062 | 69,122,112,993.00 | 473,650.00 |

| 500,000.00 — 999,999.99 | 446,625 | 167,513,386 | 99.90700 | 296,291,408,374.06 | 663,400.86 |

| 1,000,000.00 — 1,499,999.99 | 79,292 | 167,592,678 | 99.95429 | 95,099,320,931.96 | 1,199,355.81 |

| 1,500,000.00 — 1,999,999.99 | 28,756 | 167,621,434 | 99.97144 | 49,367,971,329.43 | 1,716,788.54 |

| 2,000,000.00 — 2,499,999.99 | 14,321 | 167,635,755 | 99.97998 | 31,866,540,833.10 | 2,225,161.71 |

| 2,500,000.00 — 2,999,999.99 | 8,173 | 167,643,928 | 99.98485 | 22,303,744,889.78 | 2,728,954.47 |

| 3,000,000.00 — 3,499,999.99 | 5,302 | 167,649,230 | 99.98801 | 17,132,086,593.98 | 3,231,249.83 |

| 3,500,000.00 — 3,999,999.99 | 3,634 | 167,652,864 | 99.99018 | 13,569,833,052.39 | 3,734,131.27 |

| 4,000,000.00 — 4,499,999.99 | 2,719 | 167,655,583 | 99.99180 | 11,502,119,789.27 | 4,230,275.76 |

| 4,500,000.00 — 4,999,999.99 | 2,024 | 167,657,607 | 99.99301 | 9,581,300,012.15 | 4,733,843.88 |

| 5,000,000.00 — 9,999,999.99 | 7,861 | 167,665,468 | 99.99770 | 53,257,917,392.30 | 6,774,954.51 |

| 10,000,000.00 — 19,999,999.99 | 2,684 | 167,668,152 | 99.99930 | 36,478,246,019.07 | 13,591,000.75 |

| 20,000,000.00 — 49,999,999.99 | 963 | 167,669,115 | 99.99987 | 27,613,022,901.01 | 28,673,959.40 |

| 50,000,000.00 and over | 211 | 167,669,326 | 100.00000 | 20,201,257,572.92 | 95,740,557.22 |

| Privacy Policy | Website Policies & Other Important Information | Site Map | |

Poverty and Wages

Low-Wage Workers:

Poverty and Use of Selected Federal Social Safety Net Programs Persist among Working Families

GAO-17-677: Published: Sep 22, 2017. Publicly Released: Oct 23, 2017.

Multimedia:

Additional Materials:

- Highlights Page:

- Full Report:

- Accessible Version:

Contact:

Cindy Brown-Barnes

(202) 512-7215

brownbarnesc@gao.gov

Oliver M. Richard

(202) 512-8424

richardo@gao.gov

Office of Public Affairs

(202) 512-4800

youngc1@gao.gov

(202) 512-7215

brownbarnesc@gao.gov

Oliver M. Richard

(202) 512-8424

richardo@gao.gov

Office of Public Affairs

(202) 512-4800

youngc1@gao.gov

What GAO Found

According to GAO's analysis of data in the Census Bureau's Current Population Survey (CPS), on average, low-wage workers worked fewer hours per week, were more highly concentrated in a few industries and occupations, and had lower educational attainment than workers earning hourly wages above $16 in each year GAO reviewed—1995, 2000, 2005, 2010, 2015 and 2016. Their percentage of the U.S. workforce also stayed relatively constant over time. About 40 percent of the U.S. workforce ages 25 to 64 earned hourly wages of $16 or less (in constant 2016 dollars) over the period 1995 through 2016. The combination of low wages and few hours worked compounded the income disadvantage of low-wage workers and likely contributed to their potential eligibility for federal social safety net programs.About 20 percent of families with a worker earning up to the federal minimum wage (currently $7.25 per hour), 13 percent of families with a worker earning above federal minimum wage to $12.00 per hour, and 5 percent of families with a worker earning $12.01 to $16 per hour were in poverty in each year GAO reviewed (see figure).The extent of poverty varied considerably by the type of family in which a worker lived. For example, single-parent families earning the federal minimum wage or below comprised a higher percentage of families in poverty. In contrast, married families with no children comprised the lowest percentage of families in poverty, and generally had family incomes at or above the poverty line.

Note: All references to the “federal minimum wage” are based on 110 percent of the hourly federal minimum wage in effect that year or the equivalent hourly calculated wage for salaried workers. Brackets are used to represent margins of error of estimated percentages at a 95 percent confidence level.

Families with a worker earning $16 or less per hour consistently used selected federally funded social safety net programs between 2005 and 2016, with varied factors affecting eligible families' participation. GAO estimated that the percentage of these families enrolled in Medicaid rose significantly over the past 2 decades, almost tripling among families with a worker earning more than the federal minimum wage between 1995 and 2016. In contrast, an estimated 5 percent or less of these families received cash assistance from the Temporary Assistance for Needy Families (TANF) program at least once in the prior calendar year from 1995 through 2016. A low-wage worker's family type also influenced the extent that families used selected social safety net programs. For example, among families with minimum wage earners in 2016, GAO estimated that about half or more married families used none of the programs GAO examined—Medicaid, TANF, Supplemental Nutrition Assistance Program, Earned Income Tax Credit, and Additional Child Tax Credit—while more than half of single-parent families used three or more. Program officials and others told GAO that eligible working families may not participate in programs for a variety of reasons, including time needed to apply for benefits, low benefit amounts, and assumed ineligibility.

Why GAO Did This Study

According to the Department of Labor, private-sector employers have added millions of jobs to the economy since the end of the most recent recession in 2009; however, many are in low-wage occupations. GAO was asked to examine several characteristics of low-wage workers and their families, including their use of federally funded social safety net programs over time.This report answers the following questions: (1) What are the characteristics of the low-wage workforce and how have they changed over time? (2) To what extent are families with low-wage workers in poverty? and (3) To what extent do families with low-wage workers participate in selected social safety net programs and what factors affect their participation?

GAO analyzed CPS data from 1995, 2000, 2005, 2010, 2015, and 2016 on worker characteristics, family poverty, and participation in social safety net programs. GAO defined low-wage workers as those workers ages 25 to 64 earning $16 or less per hour. In addition, GAO interviewed officials with state and local social safety net programs and other experts in four metropolitan areas—Atlanta, San Francisco, Santa Fe, and Washington, D.C.—representing a range of local minimum wage levels relative to the federal minimum wage, costs of living, and participation rates in five selected federally funded social safety net programs.

For more information, contact Cindy Brown-Barnes at (202) 512-7215 or brownbarnesc@gao.gov and Oliver Richard at (202) 512-8424 or richardo@gao.gov.

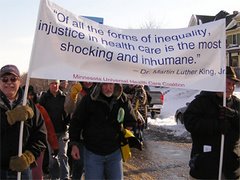

Trump takes the wrong approach to the coronavirus

Trump

and Pence are approaching this coronavirus in almost the exact same way

Eisenhower, the American Medical Association and the pharmaceutical

industry approached the polio epidemic, as a money-making opportunity,

which Dr. Salk described as “doing everything wrong.”

Polio was only eradicated when Dr. Salk and those working with him finally convinced Eisenhower that it would take a massive public effort from research through getting the vaccine out to the people for free to eradicate polio.

The effort to eradicate polio took massive public health measures including:

Public funding.

Public administration and coordination.

Public research and development for the vaccine.

Public and free distribution of the vaccine.

Dr. Salk pointed out that if left to the free enterprise for profit health care industry it was very unlikely polio would be eradicated...

Unfortunately, many people had to suffer the consequences of polio before Eisenhower came to his senses and established a public health care approach towards eradicating polio.

Dr. Salk was a firm believer and advocate of socialized health care just like Frances Perkins and Floyd Olson were two decades before him.

Had Dr. Salk not brought this discussion into the public square in a way that convinced the American people to act in a way that forced Eisenhower to come to his senses, polio would not have been eradicated here in our country.

The first thing the moron Trump has done wrong with this coronavirus is to place an ass-kissing imbecile advocate of free market for-profit health care Mike Pence in charge of overseeing this grave (pun intended) health concern.

What we are now getting is “the vaccine will be long in coming” because the pharmaceutical industry has to asses the profitability of developing the vaccine and then whatever the market will bear will determine who will be able to afford the vaccine. Once again, profits come before the health and well-being of the people. Isn’t anyone going to have the courage of a Dr. Salk to come forward and challenge Trump in a way that mobilizes the American people to demand a massive public approach to this dangerous health care crisis?

Is there such a total commitment to for-profit health care now in the health care community that no one dares to challenge the utterly stupid approach Trump has taken which has been proven wrong over and over again?

This is going to require a massive public effort.

It was the American Public Heath Association which mobilized health care workers and the American public to seek a massive public approach to solving the polio epidemic... and they had to fight tooth and nail against the private free market for-profit health care industry and the politicians that were being bribed by this industry in order to win their position.

Why isn’t the American Public Health Association (ALPHA) showing the same kind of leadership role today in fighting the coronavirus that it did with the polio epidemic? Do they fear being branded as “socialists?”

The unhealthy political environment in this country today with attacks on everything “public” in defense of the “free market for-profit” approach may leave many sick and dead... do we really have to live through such a “learning experience,” again?

Just like capitalism itself, the health care system it has spun is sick... the result:

Needless human misery and death from a disease that could be treated and prevented if only the efforts wasted on militarism and wars became a public effort.

By the way, China is a socialist country without a socialized health care system which has largely relied on profit-making entrepreneurs to provide health care with an “insurance” scheme... hopefully this coronavirus has brought Chinese leaders to their senses that they need to get rid of this method of providing health care which was pushed on them by capitalist corporations who found socialized health care to be “too great a burden” in developing joint enterprises... see the article in the Wall Street Journal: “Is Socialism Too Great a Burden for Foreign Investment?” in which a publicly owned Chinese auto manufacturing plant was providing workers with free health care.

Polio was only eradicated when Dr. Salk and those working with him finally convinced Eisenhower that it would take a massive public effort from research through getting the vaccine out to the people for free to eradicate polio.

The effort to eradicate polio took massive public health measures including:

Public funding.

Public administration and coordination.

Public research and development for the vaccine.

Public and free distribution of the vaccine.

Dr. Salk pointed out that if left to the free enterprise for profit health care industry it was very unlikely polio would be eradicated...

Unfortunately, many people had to suffer the consequences of polio before Eisenhower came to his senses and established a public health care approach towards eradicating polio.

Dr. Salk was a firm believer and advocate of socialized health care just like Frances Perkins and Floyd Olson were two decades before him.

Had Dr. Salk not brought this discussion into the public square in a way that convinced the American people to act in a way that forced Eisenhower to come to his senses, polio would not have been eradicated here in our country.

The first thing the moron Trump has done wrong with this coronavirus is to place an ass-kissing imbecile advocate of free market for-profit health care Mike Pence in charge of overseeing this grave (pun intended) health concern.

What we are now getting is “the vaccine will be long in coming” because the pharmaceutical industry has to asses the profitability of developing the vaccine and then whatever the market will bear will determine who will be able to afford the vaccine. Once again, profits come before the health and well-being of the people. Isn’t anyone going to have the courage of a Dr. Salk to come forward and challenge Trump in a way that mobilizes the American people to demand a massive public approach to this dangerous health care crisis?

Is there such a total commitment to for-profit health care now in the health care community that no one dares to challenge the utterly stupid approach Trump has taken which has been proven wrong over and over again?

This is going to require a massive public effort.

It was the American Public Heath Association which mobilized health care workers and the American public to seek a massive public approach to solving the polio epidemic... and they had to fight tooth and nail against the private free market for-profit health care industry and the politicians that were being bribed by this industry in order to win their position.

Why isn’t the American Public Health Association (ALPHA) showing the same kind of leadership role today in fighting the coronavirus that it did with the polio epidemic? Do they fear being branded as “socialists?”

The unhealthy political environment in this country today with attacks on everything “public” in defense of the “free market for-profit” approach may leave many sick and dead... do we really have to live through such a “learning experience,” again?

Just like capitalism itself, the health care system it has spun is sick... the result:

Needless human misery and death from a disease that could be treated and prevented if only the efforts wasted on militarism and wars became a public effort.

By the way, China is a socialist country without a socialized health care system which has largely relied on profit-making entrepreneurs to provide health care with an “insurance” scheme... hopefully this coronavirus has brought Chinese leaders to their senses that they need to get rid of this method of providing health care which was pushed on them by capitalist corporations who found socialized health care to be “too great a burden” in developing joint enterprises... see the article in the Wall Street Journal: “Is Socialism Too Great a Burden for Foreign Investment?” in which a publicly owned Chinese auto manufacturing plant was providing workers with free health care.

Do we need paid sick-leave for all workers?

From friend Liane Gale:

What a socially un-caring country this is. "Employees in the service industry especially, like food workers or personal care assistants, are much less likely than their peers in more lucrative fields to have paid time off if they get sick. But they also make less money in general, meaning a lost day of work hurts their families’ budgets more. That gives them a strong motivation to go into work — even if they’re not feeling well.

There is no federal law guaranteeing paid time off for illness, and paid sick leave is comparatively rare for lower-wage workers. Just 63 percent of people working in service occupations have paid sick leave, versus more than 90 percent of people in management positions, according to the Bureau of Labor Statistics. For people working part-time, just 43 percent can get sick leave from their employer."

What a socially un-caring country this is. "Employees in the service industry especially, like food workers or personal care assistants, are much less likely than their peers in more lucrative fields to have paid time off if they get sick. But they also make less money in general, meaning a lost day of work hurts their families’ budgets more. That gives them a strong motivation to go into work — even if they’re not feeling well.

There is no federal law guaranteeing paid time off for illness, and paid sick leave is comparatively rare for lower-wage workers. Just 63 percent of people working in service occupations have paid sick leave, versus more than 90 percent of people in management positions, according to the Bureau of Labor Statistics. For people working part-time, just 43 percent can get sick leave from their employer."

The coronavirus makes a good case for America finally guaranteeing paid sick leave.

A "great economy?"

I wonder why Trump has stopped boasting about how well the stock market and 401k’s are doing?

A thought to ponder as the economy goes to hell...

Here is a thought you may want to ponder:

Even when the economy is in economic recession or depression, the economy remains booming for the rich as they never suffer from poverty.

Even when the economy is in economic recession or depression, the economy remains booming for the rich as they never suffer from poverty.

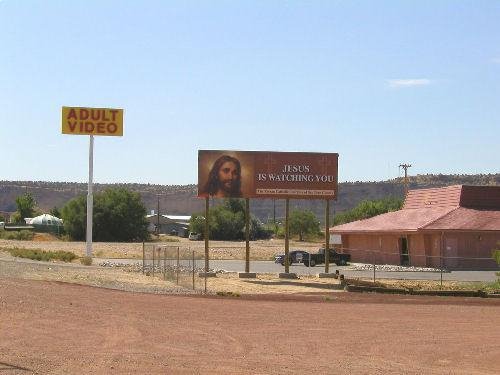

Capitalist selfishness; can we cure this disease? Working class consciousness is the anti-dote.

Capitalist selfishness permeates our society and even infects the

working class. We see this with Obamacare. Some workers praise it

because they benefit from it and don’t consider others who are left to

fend for themselves.

We saw this same kind of selfishness expressed by the crooked and corrupt millionaire leaders of the Culinary Union in Nevada, lacking all class consciousness, who would deny other workers health care because they are making (and stealing) millions of dollars from managing their union’s health and welfare funds.

We saw this same kind of selfishness expressed by the crooked and corrupt millionaire leaders of the Culinary Union in Nevada, lacking all class consciousness, who would deny other workers health care because they are making (and stealing) millions of dollars from managing their union’s health and welfare funds.

The only real health care reform that will benefit all working people

just like public education does would be a National Public Health Care

System...

Publicly funded.

Publicly administered.

Publicly delivered.

I challenge anyone to refute that this would be the best health care system for the working class.

Free health care for everyone provided through a network of neighborhood and community health care centers... just like public education.

Much better than we have now; and better than this campaign gimmick being pitched by the Bernie Sanders and his Democratic colleagues and middle class Greens being called “Medicare for All” which even if implemented maintains a market-driven for-profit health care system.

Working people need to think this through for themselves and not be so quick to grab onto these campaign gimmicks... that is all they are: gimmicks intended to trick you out of your votes getting nothing in return until you get another worthless promise come the next election.

“Medicare for All” has been used as a campaign gimmick by the Democrats since 1948... used them as a cheap trick to hoodwink workers to vote for Harry “Atom Bomber” Truman instead of the progressive Henry Wallace who had a real plan for full employment with real living wages providing the American people with things required to live a decent life like socialized health care.

And, just like with Harry “Atom Bomber” Truman... we now get this slick talk about health care reform along with the introduction of another round of anti-Communist red-baiting... from the Wall Street Democrats who are no better than Trump... and these Wall Street Democrats still deliver wars along with the Republicans even when they promise peace... another of their campaign gimmicks.

Publicly funded.

Publicly administered.

Publicly delivered.

I challenge anyone to refute that this would be the best health care system for the working class.

Free health care for everyone provided through a network of neighborhood and community health care centers... just like public education.

Much better than we have now; and better than this campaign gimmick being pitched by the Bernie Sanders and his Democratic colleagues and middle class Greens being called “Medicare for All” which even if implemented maintains a market-driven for-profit health care system.

Working people need to think this through for themselves and not be so quick to grab onto these campaign gimmicks... that is all they are: gimmicks intended to trick you out of your votes getting nothing in return until you get another worthless promise come the next election.

“Medicare for All” has been used as a campaign gimmick by the Democrats since 1948... used them as a cheap trick to hoodwink workers to vote for Harry “Atom Bomber” Truman instead of the progressive Henry Wallace who had a real plan for full employment with real living wages providing the American people with things required to live a decent life like socialized health care.

And, just like with Harry “Atom Bomber” Truman... we now get this slick talk about health care reform along with the introduction of another round of anti-Communist red-baiting... from the Wall Street Democrats who are no better than Trump... and these Wall Street Democrats still deliver wars along with the Republicans even when they promise peace... another of their campaign gimmicks.

Thoughts about the coronavirus.

What the coronavirus is proving are two things:

1. The failure of the scientific and medical community to work together in cooperation internationally thwarted by the profit-driven free market of those greedy business people seeking to get rich from our suffering; and,

2. The failure of the profit-driven free market health care system manipulated by the millionaire and billionaire monopolists.

China, limited by their reliance on “entrepreneurial” health care, is fortunate that over-all they have a socialist political system in place which has enabled them to respond very quickly to this coronavirus...

Compare the Chinese response to what Trump and Pence have to offer...

“Healthy people have nothing to worry about; they will just go through a process and that will be it.” Trump

In the meantime... one person in a nursing home in the state of Washington has died from this coronavirus while one-hundred other people living in the this nursing home went unprotected and without being tested; most of these people had people coming and going visiting them unaware of the danger they were being subjected to; with some two-hundred nursing home employees coming and going without any testing or protections... all of these visitors and workers out mingling with family, friends, co-workers and the general public... while Trump assures us he is doing everything possible to protect us... ya, sure; you betcha.

All the while the for-profit companies and health care industry will make trillions of dollars in profits.

It’s called capitalism...

Don’t shake hands with anyone and wash your hands often... kind of like suggesting kids should “duck and cover” in case of nuclear war.

Isn’t anyone else sick of this shit already?

Quite frankly, the only real hope we have in fighting this coronavirus seems to be coming from “public enemy Number One,” little socialist Cuba with a fully nationalized scientific and research community and a fully socialized health care system.

And, in spite of what anyone says, from what I see going on with the massive hate campaign against socialist China coming from Trump, all these pathetic Democrats including Bernie Sanders, the media and ilk like Steve Bannon, I am convinced this coronavirus comes from a CIA laboratory and demented Frankenstein-like scientists- monsters- found a way to deliver this virus through injecting it into animals as a way to evade detecting where it originated.

Whether or not this is what happened here is something to think about:

Why are our tax dollars funding these monsters calling themselves “scientists” to work in laboratories creating and concocting these horrendous biological weapons intended to create massive human misery aimed at our “enemies” when they should be working on finding vaccinations and cures for the coronavirus, cancers and heart diseases?

If anyone thinks this coronavirus was not concocted in one of these CIA laboratories; how do you explain the government funding this kind of research while leaving the cures for the coronavirus in the hands of profit-driven Wall Street corporations?

Sheer madness.

If anyone thinks my thinking on this is crazy... how do you describe this government engaged in such barbarity when it comes to planning for such massive death and destruction? Is this not crazy and sheer madness?

1. The failure of the scientific and medical community to work together in cooperation internationally thwarted by the profit-driven free market of those greedy business people seeking to get rich from our suffering; and,

2. The failure of the profit-driven free market health care system manipulated by the millionaire and billionaire monopolists.

China, limited by their reliance on “entrepreneurial” health care, is fortunate that over-all they have a socialist political system in place which has enabled them to respond very quickly to this coronavirus...

Compare the Chinese response to what Trump and Pence have to offer...

“Healthy people have nothing to worry about; they will just go through a process and that will be it.” Trump

In the meantime... one person in a nursing home in the state of Washington has died from this coronavirus while one-hundred other people living in the this nursing home went unprotected and without being tested; most of these people had people coming and going visiting them unaware of the danger they were being subjected to; with some two-hundred nursing home employees coming and going without any testing or protections... all of these visitors and workers out mingling with family, friends, co-workers and the general public... while Trump assures us he is doing everything possible to protect us... ya, sure; you betcha.

All the while the for-profit companies and health care industry will make trillions of dollars in profits.

It’s called capitalism...

Don’t shake hands with anyone and wash your hands often... kind of like suggesting kids should “duck and cover” in case of nuclear war.

Isn’t anyone else sick of this shit already?

Quite frankly, the only real hope we have in fighting this coronavirus seems to be coming from “public enemy Number One,” little socialist Cuba with a fully nationalized scientific and research community and a fully socialized health care system.

And, in spite of what anyone says, from what I see going on with the massive hate campaign against socialist China coming from Trump, all these pathetic Democrats including Bernie Sanders, the media and ilk like Steve Bannon, I am convinced this coronavirus comes from a CIA laboratory and demented Frankenstein-like scientists- monsters- found a way to deliver this virus through injecting it into animals as a way to evade detecting where it originated.

Whether or not this is what happened here is something to think about:

Why are our tax dollars funding these monsters calling themselves “scientists” to work in laboratories creating and concocting these horrendous biological weapons intended to create massive human misery aimed at our “enemies” when they should be working on finding vaccinations and cures for the coronavirus, cancers and heart diseases?

If anyone thinks this coronavirus was not concocted in one of these CIA laboratories; how do you explain the government funding this kind of research while leaving the cures for the coronavirus in the hands of profit-driven Wall Street corporations?

Sheer madness.

If anyone thinks my thinking on this is crazy... how do you describe this government engaged in such barbarity when it comes to planning for such massive death and destruction? Is this not crazy and sheer madness?

Looking forward to meeting with Tulsi Gabbard tomorrow...

I will be discussing some things on my mind with Tulsi Gabbard tomorrow.

Will Trump try to stop the Election?

Will Trump use the nation under threat of the spread of the coronavirus to “suspend” the 2020 Elections?

Let's have some openness conducive to a democratic society.

We have never seen the full “Church Commission” report that included

the joint FBI-CIA report known as “The Family Jewels” that remains

mostly redacted and highly censored with complete sections blacked-out.

Perhaps if this document was released to the American people in its entirety without censorship the American people would have a better understanding of just how dirty and rotten this government has been in suppressing and repressing democracy since the end of World War II, both at home and abroad.

Perhaps if this document was released to the American people in its entirety without censorship the American people would have a better understanding of just how dirty and rotten this government has been in suppressing and repressing democracy since the end of World War II, both at home and abroad.

And let’s have all the FBI’s “COINTELPRO” files fully disclosed.

Why would anyone who believes in democracy continue to support anything other than full and open disclosure?

Why are these CIA biological warfare laboratories still operating if the horrors they create are not being used? We know they were used against Cuba; why wouldn’t they be unused against China?

We know the way anti-Communism and red-baiting were used in the past to pervert U.S. foreign policy... aren’t we going to stand up and question why these ideological poisons are still being used today?

The Democratic Party establishment, using the most vicious and pernicious anti-Communism and red-baiting, is trying to cripple liberal, progressive and left thinking which is critical to having a peaceful foreign policy towards other countries and integral to domestic policies intended to make life better for the working class.

Do we want to go into another long, protracted era of anti-Communist red-baiting and all that that entails from never-ending wars making us all poor to an attack on worker’s rights and livelihoods?

Why would anyone who believes in democracy continue to support anything other than full and open disclosure?

Why are these CIA biological warfare laboratories still operating if the horrors they create are not being used? We know they were used against Cuba; why wouldn’t they be unused against China?

We know the way anti-Communism and red-baiting were used in the past to pervert U.S. foreign policy... aren’t we going to stand up and question why these ideological poisons are still being used today?

The Democratic Party establishment, using the most vicious and pernicious anti-Communism and red-baiting, is trying to cripple liberal, progressive and left thinking which is critical to having a peaceful foreign policy towards other countries and integral to domestic policies intended to make life better for the working class.

Do we want to go into another long, protracted era of anti-Communist red-baiting and all that that entails from never-ending wars making us all poor to an attack on worker’s rights and livelihoods?

Subscribe to:

Comments (Atom)