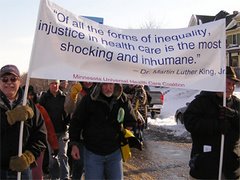

"The bottom line: This is the biggest and boldest progressive legislation in 40 years."

Oh, really? There are a few important things Bernie Horn has failed to address... read my response to Horn's essay following.

Alan L. Maki

By Bernie Horn of the Campaign for America’s Future

January 27th, 2009 - 9:00pm ET

There’s been a lot of bitching and moaning in the progressive blogosphere about the huge business tax cuts that are supposed to be contained in President Obama’s economic recovery plan.

In fairness to all, the negotiations took place behind closed doors, leaving us little solid information on which to base opinions. And over the years, we’ve had good reason to be wary of backroom deals in Congress.

But there's good news. The American Recovery and Reinvestment Act is a remarkably “clean” bill. Only between 1½ and 3 percent is being wasted on tax cuts for business. Put another way, the bill is about 98 percent pure—money dedicated to good, progressive causes.

The Congressional Budget Office (CBO) analysis, released Monday, says the business tax cuts will cause “a net revenue loss of $13 billion over the 2009-2019 period.” See the discussion on pages 11-12 of this document.

The figure of $13 billion is confirmed and explained by the House Ways and Means Committee on pages 2-3 in this document. There are only three business tax provisions that have a significant price tag. First, the extension of bonus depreciation enacted last year, allowing businesses to depreciate capital costs faster than the ordinary schedule, will cost $5 billion. Second, the 5-year carryback provision, allowing businesses to deduct net losses from the last five years instead of the last two, will cost $15 billion. Third, the repeal of a Bush Treasury Department ruling that unjustly benefits the purchasers of certain companies will increase revenues by $7 billion. So $20 billion in business tax cuts are offset by a $7 billion tax increase, leaving a total of $13 billion in benefits.

As you probably know, the Senate Finance Committee intends to make larger business tax cuts than the House bill has. The analysis of the Finance Committee’s markup, evaluated by the Congressional Joint Committee on Taxation, is on page 3 of this document. The Senate version includes both the bonus depreciation and 5-year carryback provisions, but the Joint Committee estimates these will cost a total of $22.5 billion instead of the House’s $20 billion. The Senate does not include the $7 billion tax increase and adds a bit more than $2 billion more in tax breaks for a total of $24.9 billion in business tax benefits.

The CBO tells us that the whole bill costs $816 billion. So if the Senate version is adopted, only 3 percent of the spending is for business tax breaks. (That percentage is about the same with or without the recent Alternative Minimum Tax provision.) If the House version is adopted, it’s only 1½ percent. Either way, this is a bill that is between 97 and 98.5 percent targeted toward good causes.

In our nation’s capital, no major bill ever passes without a “sweetener” for the special interests you may oppose. By Capitol Hill standards, this is an exceptionally modest sweetener. And don’t think it’s necessarily being done to gain Republican votes—key Democrats want these too.

The bottom line: This is the biggest and boldest progressive legislation in 40 years. By all means, register your complaints against the business tax cuts. But don’t let that dampen your enthusiasm for the overall measure. If you live in a state with a Republican or less-than-liberal Democratic Senator, call them today and urge them to support this bill. You'll be sorry if you don't help out, because this is history in the making.

--------------------------------------------------------------------------------

The writer is a Senior Fellow at Campaign for America’s Future and author of the recent book, Framing the Future: How Progressive Values Can Win Elections and Influence People.

My response:

Never mentioned by you and the “pundits of the left” (is that at least 30% of this "stimulus" will be sucked away in corporate profits--- more than likely well over 45% once this money passes through all the hands… untold billions sucked off by the banks in interest (at least double before its all paid back because these are loans paying for all of this); and what you refuse to acknowledge is the American tax-payer first subsidized these loans to the banks AND now those loans (remember, this money was never loaned out because no companies wanted to borrow due to a crumbling economy )… so, surprise, surprise--- Obama just borrowed this money (OUR tax money) back from the bankers!!

Rather than stimulating anything other than a capitalist feeding frenzy at an expanded public trough… these “stimulus” packages are going to further depress the economy for the simple reason that these capitalist pigs will be lapping up the cream before this money can circulate and get into the pockets of working people.

Even Paul Krugman says it will take at least triple and it was relatively easy for anyone who has been following what has been going on with the economy to see that with such “stimulus packages” it would take five to six trillion dollars before working people would gain any relief at all as the economy goes to hell.

Plus, we shouldn’t even be worried about stimulating the capitalist economy other than to expose the futileness of such schemes and their primary intent: to provide a way for capitalists to get richer at our expense by stealing the wealth they could not initially attain through exploitation of labor.

We need to be supporting “public programs” giving relief to workers to help them through this as we move people into struggle against capitalism… we have no interest in propping up and saving this rotten system.

And who knows how much of this “stimulus” money will be siphoned off as sheer graft and corruption? We have seen what has been going on with the "bailouts" to date.

Capitalism is in crisis.

You might want to consider this from Frederick Engels writing in Socialism: Utopian and Scientific:

* * *

Commerce is at a standstill, the markets are glutted, products accumulate, as multitudinous as they are unsaleable, hard cash disappears, credit vanishes, factories are closed, the mass of the workers are in want of the means of subsistence, because they have produced too much of the means of subsistence; bankruptcy follows upon bankruptcy, execution upon execution. The stagnation lasts for years; productive forces and products are wasted and destroyed wholesale, until the accumulated mass of commodities finally filter off, more or less depreciated in value, until production and exchange gradually begin to move again. Little by little the pace quickens. It becomes a trot. The industrial trot breaks into a canter, the canter in turn grows into the headlong gallop of a perfect steeplechase of industry, commercial credit and speculation, which finally, after breakneck leaps, ends where it began--in the ditch of a crisis. And so over and over again. We have now, since the year 1825, gone through this five times, and at the present moment (1877) we are going through it for the sixth time.... The fact that the socialised organisation of production within the factory has developed so far that it has become incompatible with the anarchy of production in society, which exists side by side with and dominates it, is brought home to the capitalists themselves by the violent concentration of capital that occurs during crises, through the ruin of many large, and a still greater number of small, capitalists. The whole mechanism of the capitalist mode of production breaks down under the pressure of the productive forces, its own creations. It is no longer able to turn all this mass of means of production into capital. They lie fallow, and for that very reason the industrial reserve army must also lie fallow. Means of production, means of subsistence, available labourers, all the elements of production and of general wealth, are present in abundance. But "abundance becomes the source of distress and want" (Fourier), because it is the very thing that prevents the transformation of the means of production and subsistence into capital. For in capitalistic society the means of production can only function when they have undergone a preliminary transformation into capital, into the means of exploiting human labour power.

Frederick Engels's---

Socialism: Utopian and Scientific/

New York: International Publishers, 1935, pages 64-65

Add to this the fact the complete waste from wars and militarism including billions of dollars we are pumping into the Israeli killing machine and the only thing Obama is doing is setting up the working class for massive poverty and all the misery associated with poverty.

Bernie horn stated:

"...the bill is about 98 percent pure—money dedicated to good, progressive causes..."

Since when do progressives consider tax-money dedicated to corporate profits, corruption and graft, "good, progressive causes."

Print this blog posting off and stick a few copies in your lunch pail to discuss with fellow workers during lunch break.

Alan L. Maki